The ROI of HRIS Implementation: How Philippine Companies Save Time and Costs Through Automation with HRIS Philippines

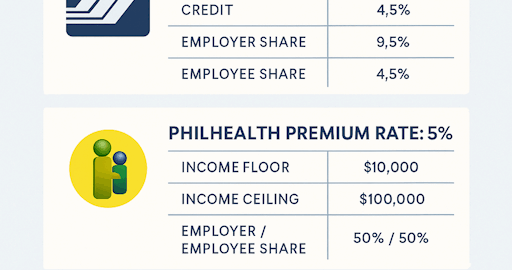

Introduction: The Real Cost of Manual HR Operations Every payroll cycle, thousands of HR teams across the Philippines spend hours reconciling attendance sheets, validating overtime, and ensuring compliance with DOLE, SSS, PhilHealth,Read More…