Introduction

Every year, the government updates contribution rates for SSS (Social Security System), PhilHealth, and Pag-IBIG Fund. For HR and payroll teams, keeping up with these changes is critical to ensure compliance, accurate payroll processing, and employee trust.

In 2025, the contribution schedules reflect adjustments based on Republic Act No. 11199 (SSS Act of 2018), Universal Health Care Law (RA 11223), and Pag-IBIG Fund circulars.

This guide provides:

- Updated contribution tables for 2025

- Employer vs employee share breakdowns

- Payroll examples for HR teams

- Compliance reminders from DOLE

- How HRIS like Everything at Work automates these deductions

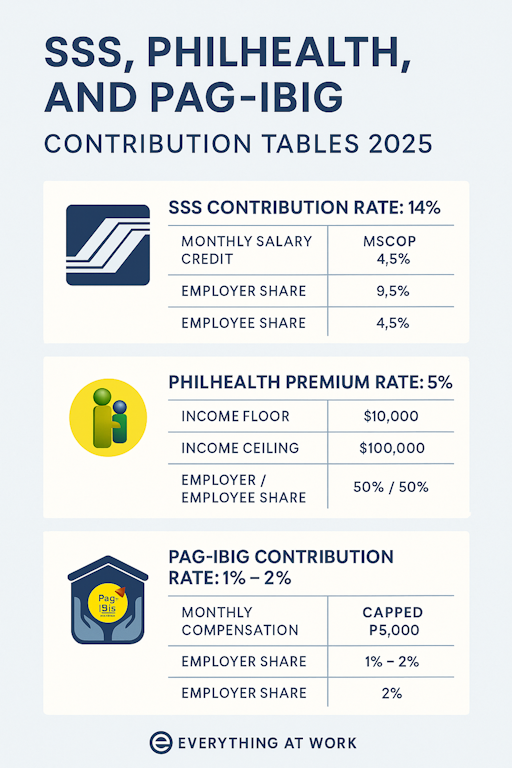

📌 1. SSS Contribution Table 2025

The SSS contribution rate remains at 14% of monthly salary credit (MSC) in 2025, with a gradual increase scheduled up to 15% by 2025–2026.

- Employer share: 9.5%

- Employee share: 4.5%

- MSC Range: ₱4,000 – ₱30,000

Example:

- Employee salary: ₱20,000

- Total SSS contribution: ₱2,800 (14% of ₱20,000)

- Employer: ₱1,900

- Employee: ₱900

✅ Reminder: Employers must remit SSS contributions via My.SSS portal or accredited banks by the monthly deadline.

📌 2. PhilHealth Contribution Table 2025

Under the Universal Health Care Law (RA 11223), PhilHealth contributions are gradually increasing.

- Premium Rate: 5% of monthly basic salary

- Income Floor: ₱10,000

- Income Ceiling: ₱100,000

- Shared equally by employer and employee (50-50 split).

Example:

- Employee salary: ₱20,000

- Contribution = 5% of ₱20,000 = ₱1,000

- Employer: ₱500

- Employee: ₱500

✅ Reminder: Premiums must be remitted through the PhilHealth Electronic Premium Remittance System (EPRS).

📌 3. Pag-IBIG Contribution Table 2025

Pag-IBIG contributions remain 1% to 2% of monthly compensation (depending on income), with the employer matching the employee share up to 2%.

- Employee share: 1% (if ₱1,500 and below) or 2% (if above ₱1,500)

- Employer share: 2% (for all)

- Maximum compensation used: ₱5,000 (unless adjusted by circular)

Example:

- Employee salary: ₱20,000

- Employee: ₱100 (2% of ₱5,000 cap)

- Employer: ₱100

- Total = ₱200

✅ Reminder: Pag-IBIG contributions can be remitted via Virtual Pag-IBIG portal or accredited payment partners.

📊 4. Payroll Example with All Contributions

Let’s compute for an employee with a monthly salary of ₱20,000:

- SSS = ₱2,800 (Employer ₱1,900 + Employee ₱900)

- PhilHealth = ₱1,000 (Employer ₱500 + Employee ₱500)

- Pag-IBIG = ₱200 (Employer ₱100 + Employee ₱100)

Total Deductions for Employee = ₱1,500

Total Employer Cost = ₱2,500

Total Government Remittance = ₱4,000

📌 5. Common Payroll Mistakes to Avoid

- ❌ Using outdated contribution tables.

- ❌ Forgetting income ceilings (PhilHealth ₱100k cap, Pag-IBIG ₱5k cap).

- ❌ Incorrect employer-employee share allocation.

- ❌ Late remittances → penalties and interest.

- ❌ Manual miscalculations in payroll spreadsheets.

📌 6. How Everything at Work HRIS Helps

Manually tracking government contributions is error-prone. Everything at Work HRIS ensures:

- ✅ Automatic computation of SSS, PhilHealth, and Pag-IBIG per payroll period

- ✅ Auto-application of ceilings and salary ranges

- ✅ DOLE-compliant reports, ready for audits

- ✅ Seamless e-submission integration (EPRS, Virtual Pag-IBIG)

- ✅ Employee visibility via the Self-Service Portal

📌 7. DOLE Compliance Reminder

Employers must remit contributions on time and provide payslips that clearly show government deductions. Non-compliance can result in penalties, surcharges, and employee complaints filed with DOLE.

Conclusion

For HR managers, payroll officers, and business owners, keeping contribution rates updated is non-negotiable. In 2025, with the new SSS, PhilHealth, and Pag-IBIG schedules, automation is no longer just convenient — it’s essential.

By using Everything at Work HRIS, companies eliminate the risk of errors, ensure compliance, and build employee trust through transparent payroll processing.

Want to simplify payroll and government remittances?

Book a Demo with Everything at Work and see how automation can save your HR team hours every month.