Introduction

In the Philippines, HR managers and employees often confuse final pay with separation pay. While both involve payments to an employee leaving the company, they serve different purposes and follow different rules.

To avoid disputes and ensure compliance with DOLE regulations, HR teams must understand the clear distinctions. This 2025 guide breaks down:

- The legal basis of final pay vs separation pay

- When each applies

- Computation examples

- DOLE reminders for compliance

📌 What is Final Pay?

Final pay refers to the total amount due to an employee upon separation from the company, regardless of the reason (resignation, retirement, termination, or end of contract).

It usually includes:

- Last salary earned

- Pro-rated 13th month pay

- Conversion of unused Service Incentive Leave (SIL)

- Other earned benefits

- Less: loans, cash advances, or accountabilities

DOLE Rule: Must be released within 30 days from separation (Labor Advisory No. 6, Series of 2020).

📌 What is Separation Pay?

Separation pay is a statutory benefit paid to an employee when termination is due to certain authorized causes under the Labor Code of the Philippines.

Authorized causes that require separation pay (Art. 298–299):

- Retrenchment to prevent business losses

- Redundancy

- Closure/cessation of business not due to serious losses

- Disease that cannot be cured within 6 months and continued employment is prohibited by law

Separation Pay Rates (per DOLE):

- One month pay or at least 1/2 month pay per year of service (depending on the cause)

- Fraction of at least 6 months is considered 1 full year

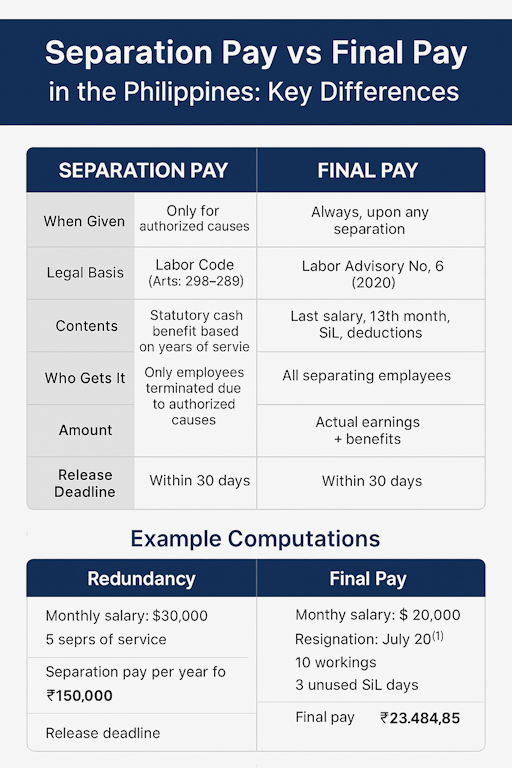

📊 Key Differences Between Final Pay and Separation Pay

| Aspect | Final Pay | Separation Pay |

| Legal Basis | Labor Advisory No. 6 (2020) | Labor Code of the Philippines (Arts. 298–299) |

| When Given | Always, upon any separation | Only for authorized causes (retrenchment, redundancy, etc.) |

| Contents | Last salary, 13th month, SIL, deductions | Statutory cash benefit based on years of service |

| Release Deadline | Within 30 days | Same as termination payout, usually within 30 days |

| Who Gets It | All separating employees | Only employees terminated due to authorized causes |

| Amount Basis | Actual earnings + benefits | 1 month or 1/2 month per year of service |

📊 Example Computations

Example 1: Resignation (Final Pay only)

- Monthly salary: ₱20,000

- Resigned July 20, 2025 (worked 10 days in July)

- Unused SIL: 3 days

Final Pay = ₱23,484.85 (as computed in prior guide)

👉 No separation pay, since resignation is voluntary.

Example 2: Redundancy (Final Pay + Separation Pay)

- Monthly salary: ₱30,000

- 5 years of service

- Terminated due to redundancy

Final Pay:

- Last salary + 13th month + SIL (if any)

Separation Pay:

- 1 month pay per year of service

- ₱30,000 × 5 = ₱150,000

👉 Employee receives both Final Pay + Separation Pay.

⚠️ Common Mistakes by Employers

- ❌ Treating final pay and separation pay as the same.

- ❌ Not paying separation pay when redundancy/authorized causes apply.

- ❌ Incorrect computation of years of service (ignoring 6-month rule).

- ❌ Late release of final pay, violating DOLE’s 30-day rule.

💡 How Everything at Work HRIS Helps

Manually computing both final and separation pay can be error-prone. Everything at Work HRIS ensures:

- ✅ Automated final pay computation (salary, 13th month, SIL, deductions)

- ✅ Separation pay calculator (per year of service, based on cause)

- ✅ DOLE-compliant reports for audits

- ✅ Transparent payslip breakdowns in the Employee Portal

With EAW, HR avoids compliance risks and employees get fair, accurate payouts.

Conclusion

While final pay is required for all separated employees, separation pay is only for those terminated due to authorized causes under the Labor Code.

By understanding and automating both, employers ensure legal compliance and maintain good employee relations.

Avoid payroll disputes and DOLE penalties. Book a Demo with Everything at Work to see how our HRIS simplifies final pay and separation pay computations.