Introduction

One of the most sensitive tasks for HR and payroll teams in the Philippines is computing the final pay of an employee who has resigned, retired, or been terminated. Errors or delays can lead to DOLE complaints, employee dissatisfaction, and even legal disputes.

According to DOLE Labor Advisory No. 6, Series of 2020, employers are required to release final pay within 30 calendar days from the employee’s separation — unless a more favorable company policy or contract states otherwise.

This article will serve as your 2025 guide for computing final pay correctly and on time.

📌 What is Final Pay?

Final pay is the total monetary benefit due to an employee upon separation from the company, regardless of the reason (resignation, retirement, termination, or end of contract).

It includes:

- Last salary earned

- Pro-rated benefits (13th month pay, SIL, etc.)

- Unused leave conversions (if applicable)

- Deductions (loans, cash advances, accountabilities)

📋 Components of Final Pay

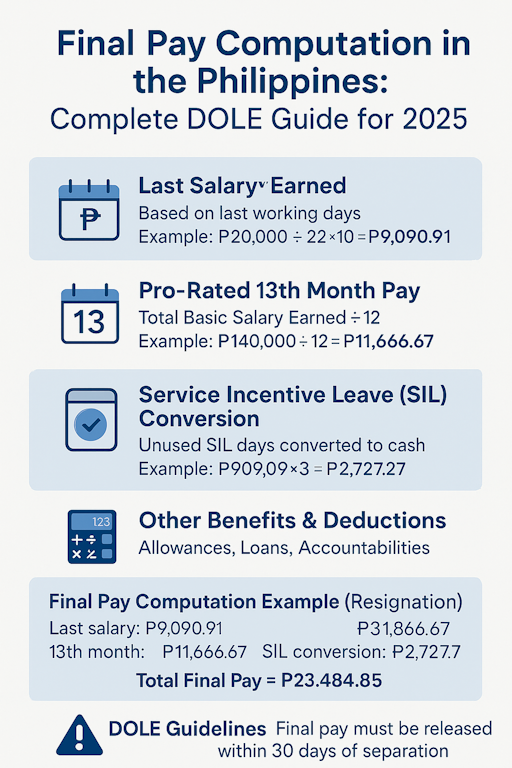

✅ 1. Last Salary Earned

- Computed based on the employee’s last working days.

- Includes basic salary + regular allowances (if considered part of basic pay).

- Excludes OT, holiday pay, or other extra pay not earned.

Example:

- Monthly salary: ₱20,000

- Resigned effective July 20 (worked 10 days in July, assuming 22 workdays)

- Computation: ₱20,000 ÷ 22 × 10 = ₱9,090.91

✅ 2. Pro-Rated 13th Month Pay

Formula:

13th Month Pay = (Total Basic Salary Earned ÷ 12)

Example:

- Salary: ₱20,000/month

- Worked Jan–July 2025 (7 months)

- Total Salary Earned = ₱140,000

- 13th Month = ₱140,000 ÷ 12 = ₱11,666.67

✅ 3. Service Incentive Leave (SIL) Conversion

- Employees who served at least 1 year are entitled to 5 SIL days per year.

- Unused SIL days are convertible to cash upon separation.

Example:

- Daily rate = ₱20,000 ÷ 22 = ₱909.09

- 3 unused SIL days = ₱909.09 × 3 = ₱2,727.27

✅ 4. Other Benefits & Deductions

- Pro-rated allowances (if included in policy).

- Company loans, cash advances, accountabilities (e.g., laptops, uniforms).

- Tax adjustments, if necessary.

📊 Final Pay Computation Example (Resignation)

Employee details:

- Monthly Salary: ₱20,000

- Resigned: July 20, 2025

- Unused SIL: 3 days

- No outstanding loans

Computation:

- Last salary: ₱9,090.91

- 13th month (pro-rated): ₱11,666.67

- SIL conversion: ₱2,727.27

Total Final Pay = ₱23,484.85

📌 DOLE Guidelines (2025 Reminder)

- Final pay must be released within 30 days of separation.

- Employers must issue a Certificate of Employment (COE) upon request.

- Taxation rules still apply (unless exempt under TRAIN Law thresholds).

⚠️ Common Mistakes in Final Pay Computation

- ❌ Not prorating 13th month pay correctly.

- ❌ Forgetting SIL conversion.

- ❌ Deducting unauthorized charges.

- ❌ Late release beyond 30 days.

- ❌ Lack of payslip or breakdown given to the employee.

💡 How Everything at Work HRIS Helps

Final pay can be tricky, especially when multiple factors (resignation dates, leaves, deductions) are involved. Everything at Work HRIS automates:

- ✅ Prorated salary and 13th month computations

- ✅ SIL balance tracking and conversion

- ✅ Deduction management (loans, advances, equipment)

- ✅ DOLE-compliant reporting with breakdowns

- ✅ Payslip generation for transparency

With EAW, HR teams avoid disputes and ensure a smooth offboarding process.

Conclusion

Computing final pay correctly is both a legal obligation and a trust issue. For 2025, DOLE remains strict in enforcing payroll compliance, and SMEs must ensure they compute and release separation pay within the 30-day period.

By automating with Everything at Work HRIS, companies can protect themselves from compliance risks while maintaining employee goodwill.

Simplify payroll compliance, from onboarding to final pay. Book a Demo with Everything at Work today.